Fill Your Calendar with Accredited Investors in Less Than 30 Days

Backed by the Raise Ready commitment.

Schedule a quick call to see if we're a fit

We serve alternative investment managers who:

Why Sponsors Choose Raise Ready to Raise Capital from Accredited Investors

.webp)

We Tailor Your Offering Narrative to Best Align with Accredited Investors

Most offerings get ignored because they sound like everyone else. We transform yours into a story accredited investors want to be part of—highlighting clarity, credibility, and opportunity. Build a brand investors trust instantly, instead of getting lost in the noise.

We Build a List of Investors Who Expressed Interest in Your Offering

Your personal network was just the beginning. Our targeted campaigns fill your pipeline with accredited prospects who know what they want out of their next placement. Stop begging for attention and start attracting serious interest.

.webp)

We Call Every Investor Lead On Your Behalf to Vet and Schedule Them

A slow speed to lead kills investor engagement. Our Investor Concierge Team calls every prospect within minutes, vetting them and scheduling sales-qualified meetings for you. Spend time only with investors ready to talk business.

We Energize Your Investor Relations with Proven Sales Meeting Scripts

Don't leave millions of dollars to chance. We equip you with proven talk tracks, a structured call flow, and objection handling strategies that sharpen your close rate. Step into every meeting with confidence and walk out with commitments.

We Analyze Every Investor Meeting and Provide Feedback for Improvement

Without data, every investor meeting feels like a shot in the dark. We turn every conversation into actionable insights, identifying patterns, and optimizing your pitch over time. Each investor meeting becomes more impactful than the last.

We Position You as the Definitive Thought Leader in Your Asset Class

Attention is continuously earned or it disappears. We help you stay top of mind by delivering strategic insights, enhancing your brand, and building a community of repeat investors. Stay relevant, stay trusted, and stay first in line for their next commitment.

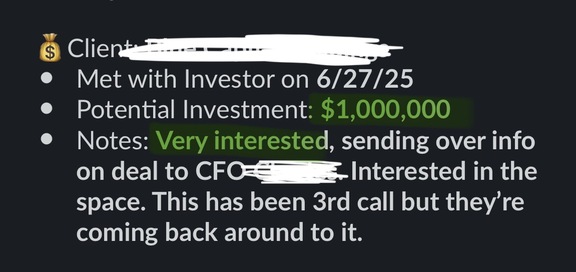

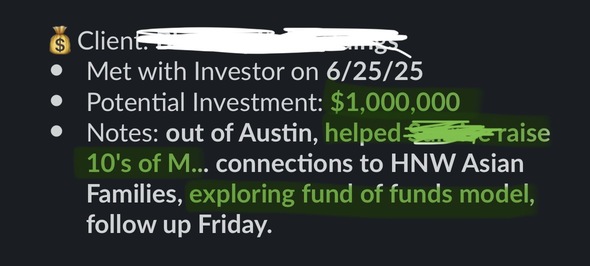

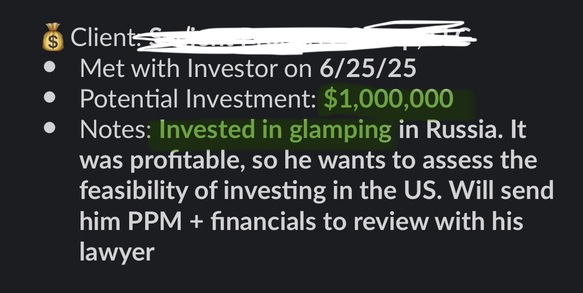

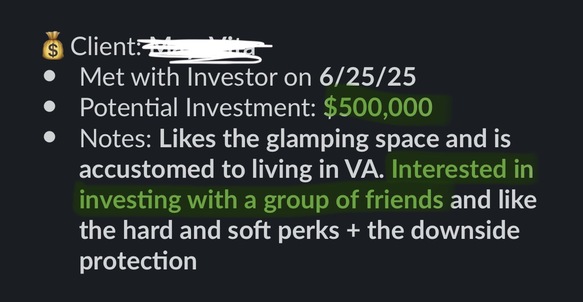

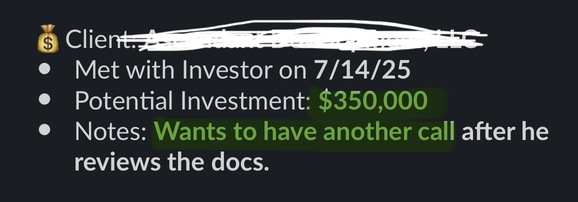

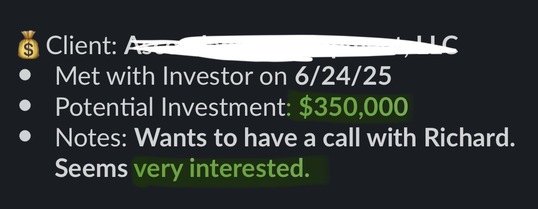

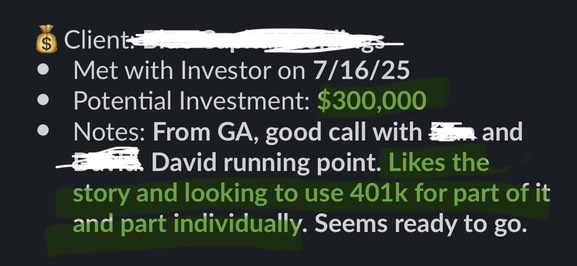

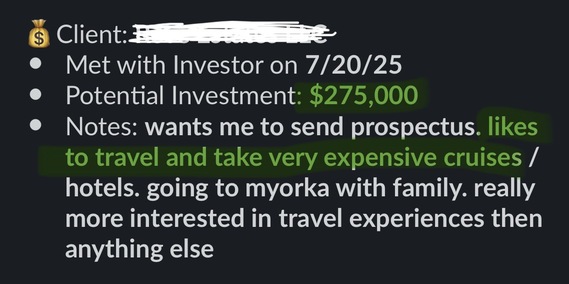

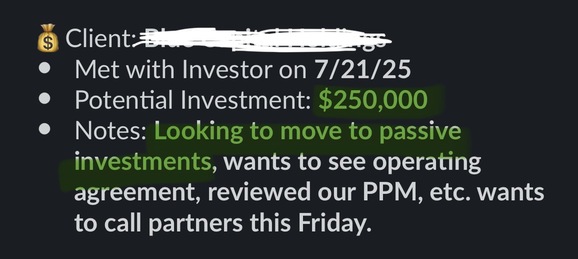

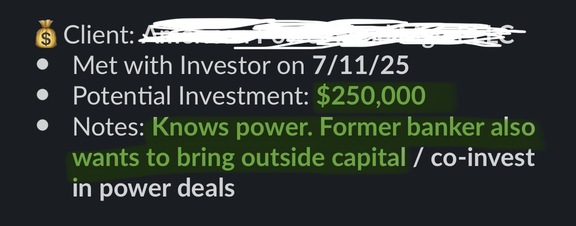

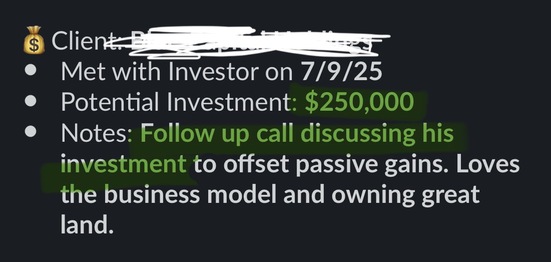

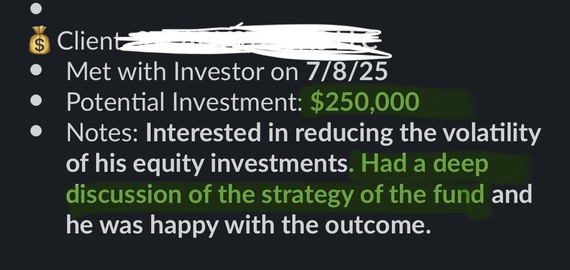

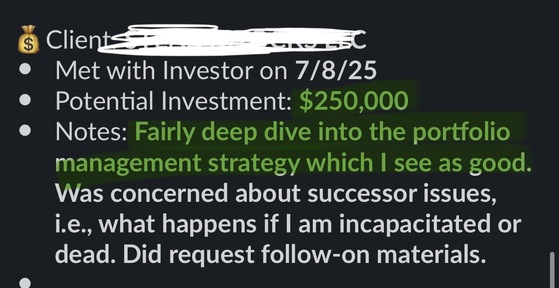

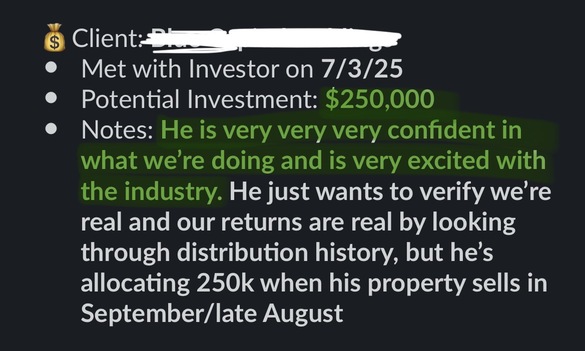

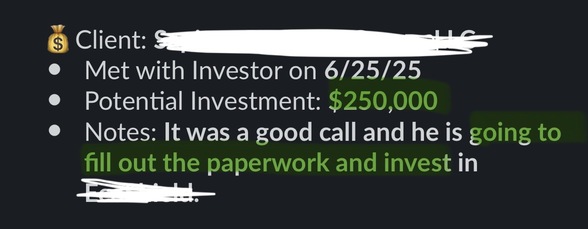

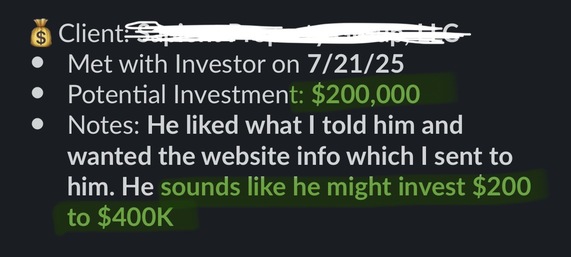

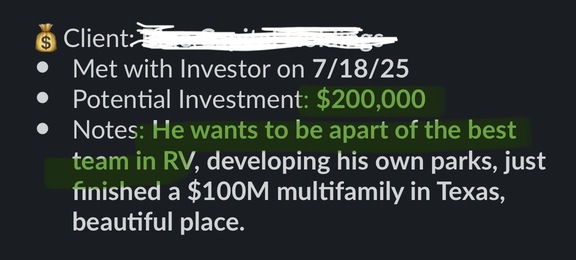

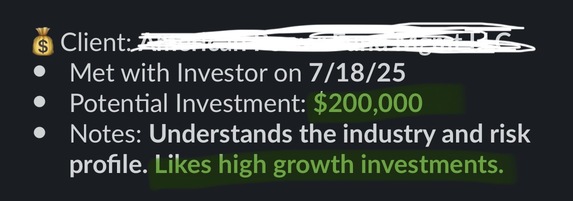

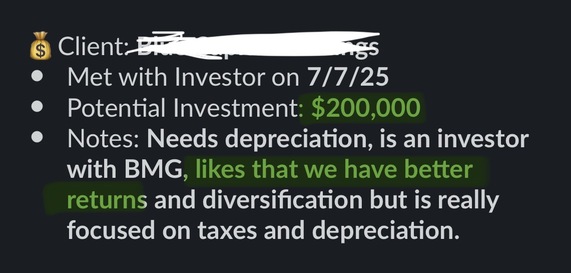

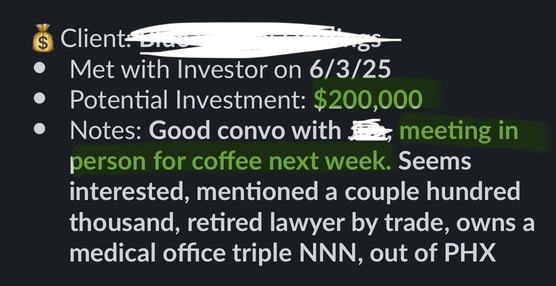

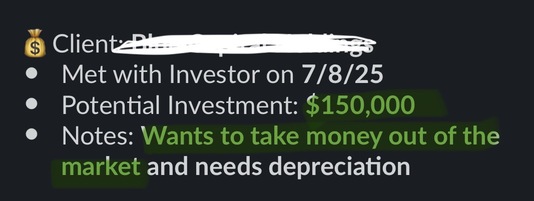

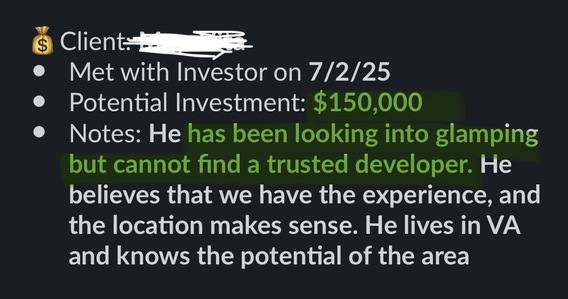

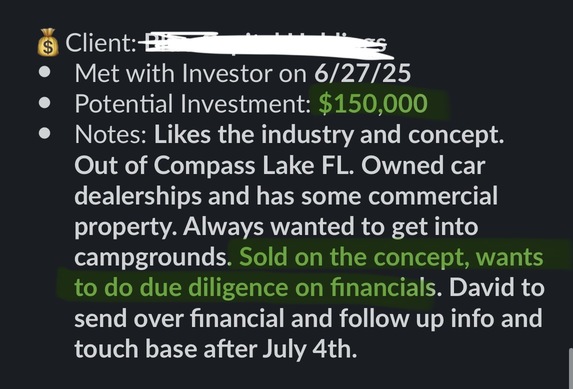

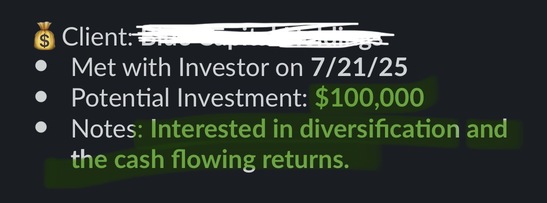

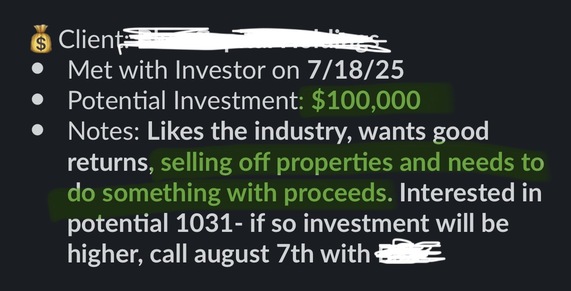

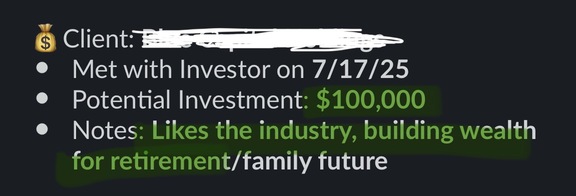

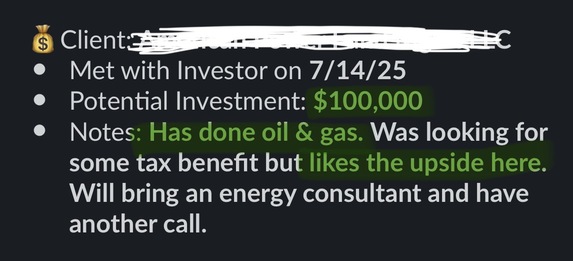

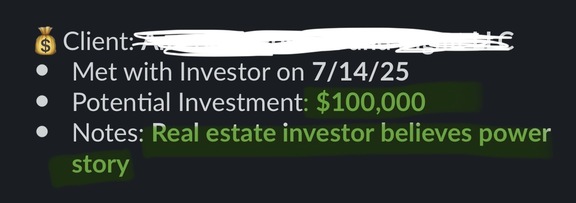

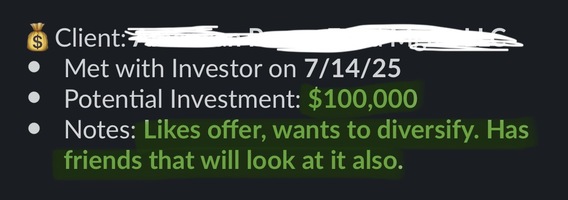

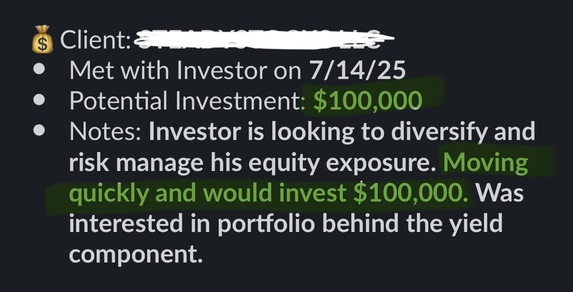

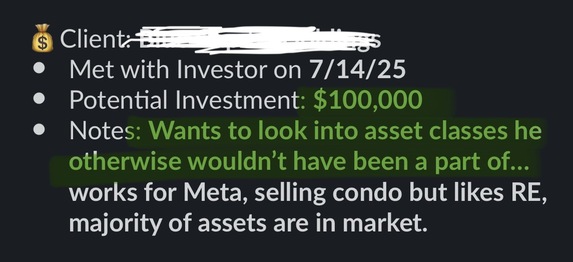

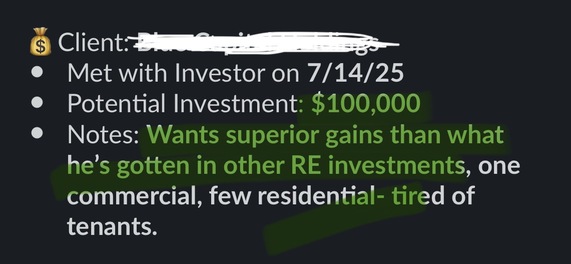

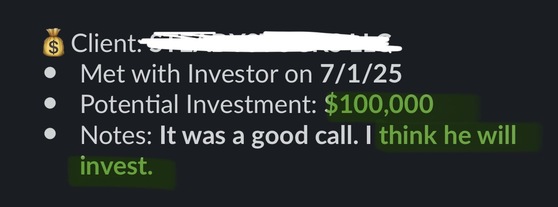

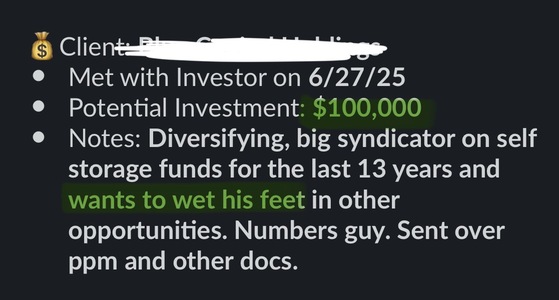

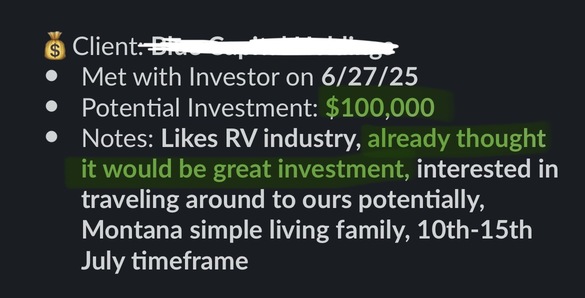

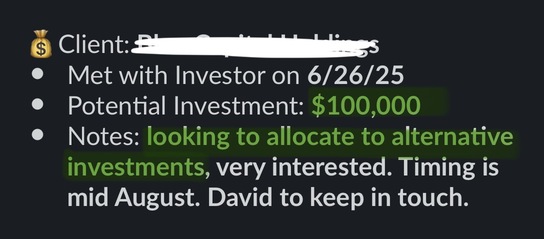

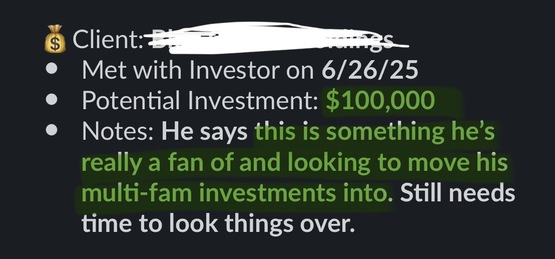

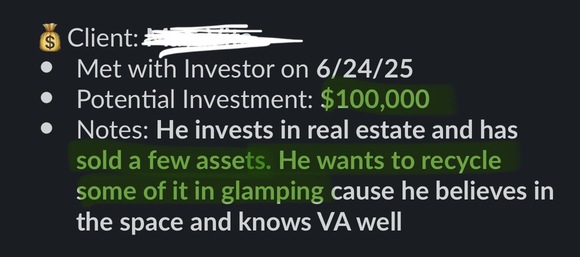

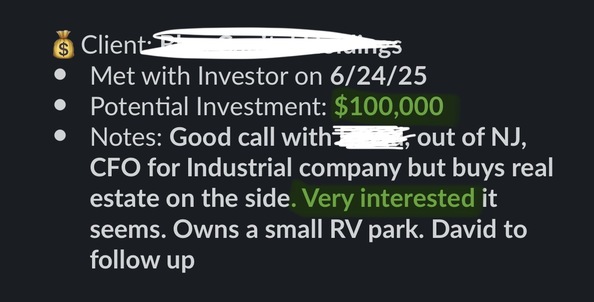

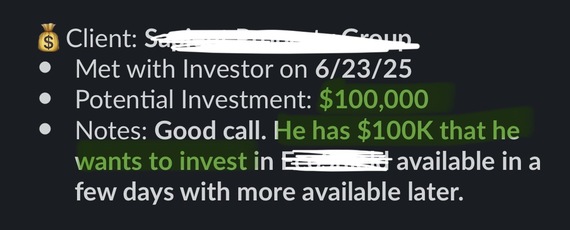

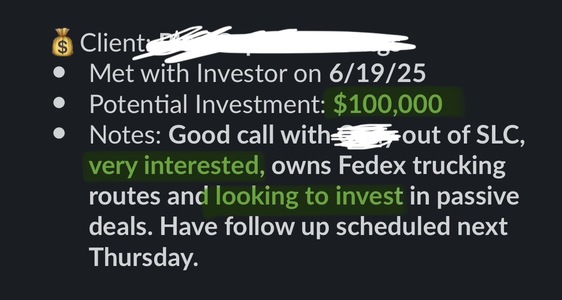

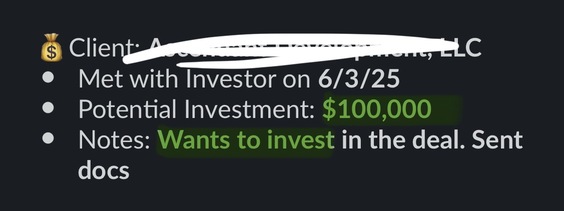

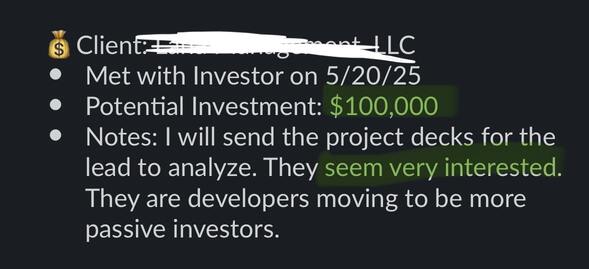

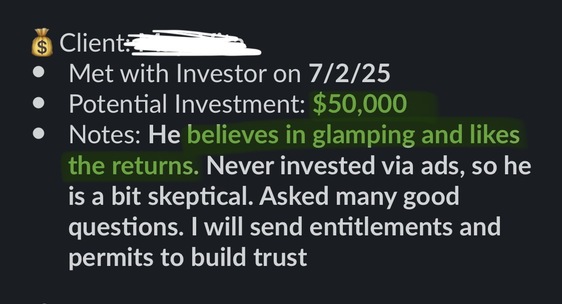

Real Investors. Real Meetings. Real Intent. Powered by Raise Ready.

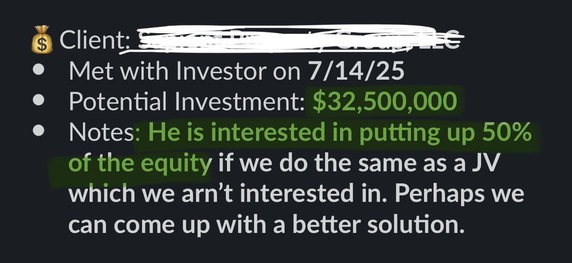

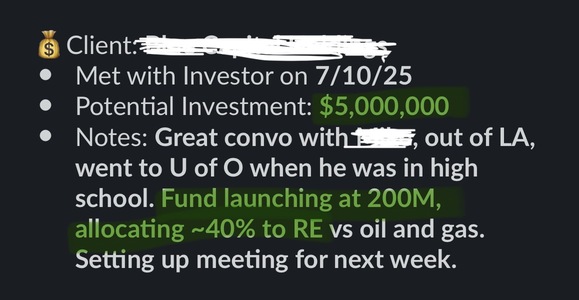

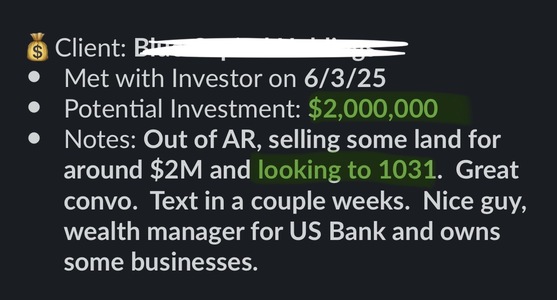

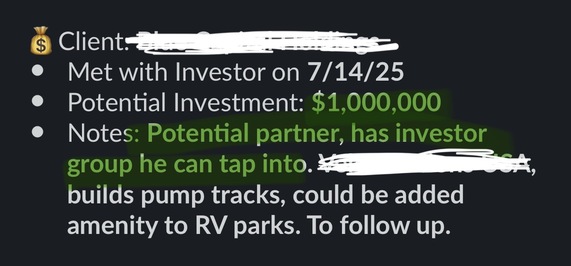

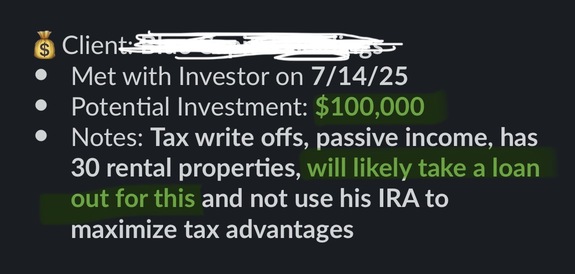

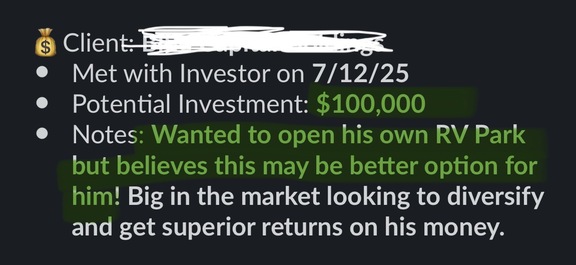

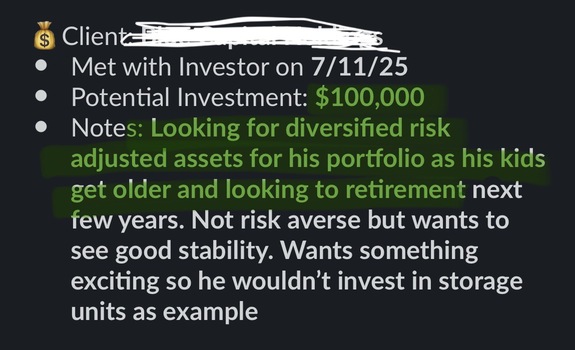

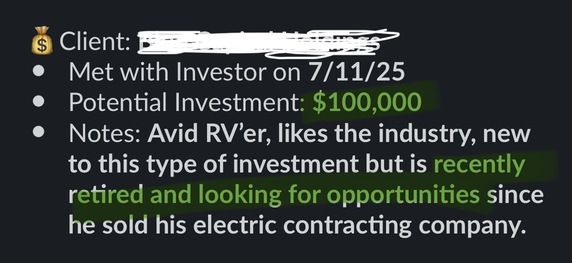

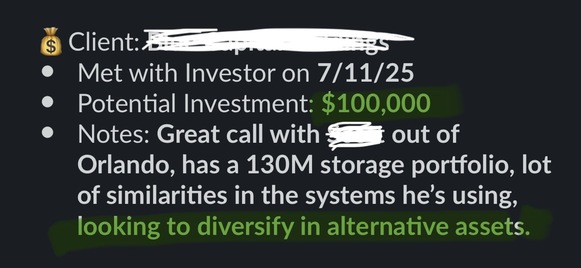

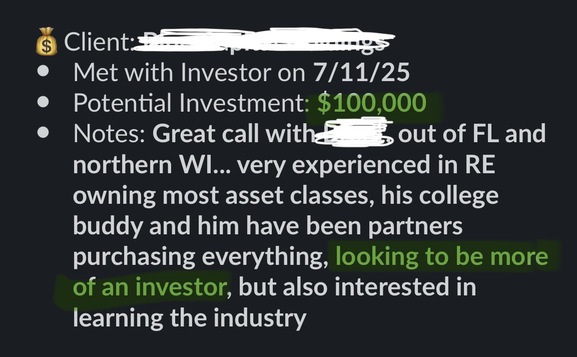

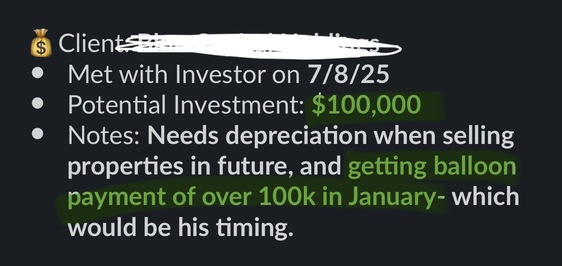

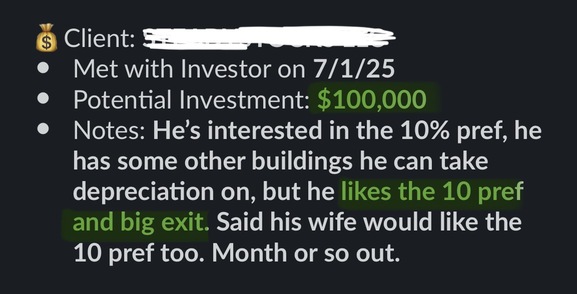

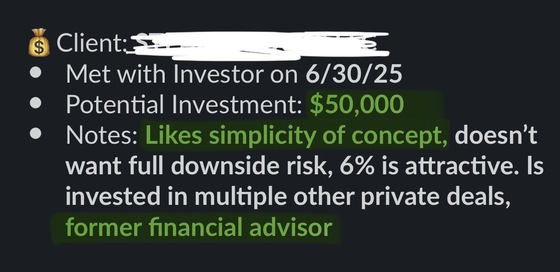

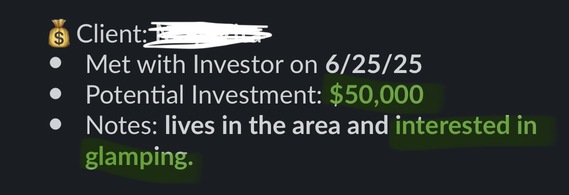

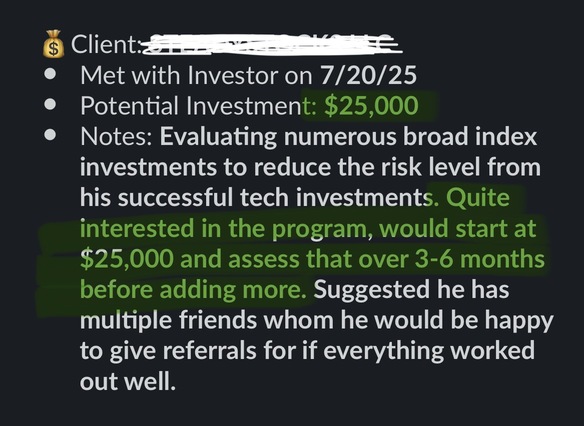

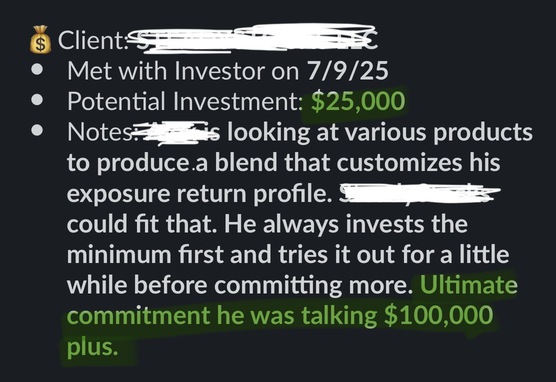

We collect feedback from our clients on every investor meeting. Every conversation here began with a Raise Ready campaign. These are the kinds of meetings our clients are having every week—with real investors, ready to commit.

Frequently Asked Questions

We don’t use a private network or a static list of investors. Instead, we run targeted campaigns on Meta (Facebook and Instagram) to find accredited investors in real time.

These platforms allow us to reach the most qualified, high-intent prospects based on actual behavior and interest signals.

We don’t wait for the right investors to show up—we go out and find them. It’s faster, smarter, and far more scalable than working off of a static list and hoping there's interest.

We deliver meetings with accredited investors—not just raw leads.

Each prospect has reviewed your specific offering and expressed interest before being scheduled. Our Investor Concierge Team personally calls every investor to confirm their interest, verify they meet your investment criteria, and ensure they’ve received your marketing materials. Only after this do we add them to your calendar.

It’s a structured, qualified process designed to give you real conversations.

Most marketing agencies stop at traffic or leads—we go much further.

We work closely with you to craft messaging that speaks to accredited investors and, when needed, we help upgrade your branding and presentation materials.

Our Investor Concierge team also personally calls every investor to confirm they meet your investment criteria and are serious about wanting to learn more.

We also help optimize your investor meetings with proven talk tracks, reviewing every investor conversation, and suggesting follow-ups.

It’s a full-funnel, hands-on approach built specifically for capital raising, and we stay with you until the capital is committed.

We’ve built a system to qualify investors before they ever land on your calendar.

First, we attract the right audience with messaging and materials designed to resonate with serious, right-fit accredited investors.

Then, we pre-qualify them by collecting key information upfront, then personally call each lead to confirm their interest, verify their contact details, and ensure they meet your investment criteria.

Only those who are sales-qualified move forward to your calendar. It’s how we protect your time and ensure every meeting is a high-quality one.

We don’t charge success fees. Instead, we work on a flat monthly retainer and advise you on an appropriate advertising budget based on your goals.

This structure gives you predictable costs and allows us to focus entirely on building a scalable, high-performing investor acquisition system.

Many of our clients start with modest ad spend and scale up once they see the quality of investor meetings coming through.

Compared to hiring an internal marketing team or cobbling together multiple agencies, our approach is far more efficient, effective, and focused.

While we’re not responsible for closing capital, we consistently put sponsors in front of serious, accredited investors who are actively evaluating new opportunities.

In the past year, our clients have added over $1.22 billion to their investor pipelines, with top performers raising $1M–2M+ per month at sub-3% cost of capital. Over 12–24 months, we’ve seen raises of $10M–20M, and in one case, a 43% repeat investor rate on a $16M fund.

Conversion rates from meeting to investment could range from 5–20%, with lead to wire timelines spanning from two days to over a year.

Clients who see the strongest results are the ones who fully commit to the process—consistently showing up, following up, and building trust.

We’ve seen investors wire funds within 2 to 4 days of seeing an ad, but most clients begin seeing meaningful traction within 30 to 60 days of launch.

The first 30 days arefocused on building out your marketing assets—messaging, creative, and campaign structure. Once live, qualified investor meetings typically begin quickly and build momentum from there.

This isn’t just about fast wins—it’s about creating a consistent pipeline of investor-ready conversations. Over time, that consistency compounds into lasting capital relationships.

There are no guarantees in capital raising from investors—and anyone who promises otherwise isn't being honest.

Our role is to deliver qualified, accredited investor meetings with prospects who’ve shown real interest.

What happens from there depends on your offering, your pitch, and your ability to build trust. We support your sales process with strategic guidance, but the decision to invest always rests with the investor.

Some clients hit or exceed their raise goals, others continue nurturing relationships with multi-million-dollar prospects, while some need to refine their strategy.

This is true across the industry—whether you're working with us or raising institutional capital through a placement agent. Our role is to bring the right people to the table.

To comply with SEC regulations, your offering must fall under Reg D 506(c), Reg A, or Reg CF—structures that permit general solicitation to investors without a prior relationship.

If your raise is structured under Reg D 506(b), we’re not a fit, as public advertising would not be allowed under that exemption. In those cases, we recommend consulting your attorney to explore whether restructuring your raise for future campaigns makes sense.

If you haven’t finalized your capital raise structure yet, we can refer you to a securities attorney experienced in compliant offerings.

While legal structuring is being finalized, we’re able to develop your campaign strategy and creative assets in parallel.

Ensuring compliance from day one is the foundation of a successful—and sustainable—investor acquisition strategy.

This isn’t a set-it-and-forget-it solution. You’ll need to be available for investor meetings, collaborate on messaging and content, and stay engaged as your pipeline builds.

Whether we’re feeding a full-time investor relations team, you’re handling investor relations yourself, or preparing to make your first hire, someone needs to be responsible for showing up to those conversations.

We take care of strategy, creative, vetting, and follow-up—so you can focus on what matters most: building trust and closing capital.

Sponsors who succeed treat this as a serious investor acquisition system, not just another marketing campaign.

To get started, we need your basic deal information that you share with investors—your investment thesis, target raise, minimum check size—and a short background on you and your team.

If you have a pitch deck, great; if not, we can help create one. We also ask that your legal structure is either in place or being finalized, so we can run a compliant campaign.

You don’t need a website or social media—we handle setup of all landing pages and advertising channels internally. In fact, we’ve helped raise millions for clients who were still developing their websites on the side.

As long as you’re responsive and collaborative, we’ll guide the process and have your campaign ready to launch in 30 days or less.

We’ve been in the capital syndication space for over five years, with a focus on helping sponsors get in front of serious, accredited investors.

Early on, we partnered with a handful of visionary GPs and supported them in raising over $42M across multiple funds and assets. That experience led our co-founder, Vitaliy, to join CrowdStreet to better understand capital raising at scale—and it ultimately inspired the creation of Raise Ready Systems.

This version of our firm is the result of decades spent refining what works in branding, advertising, and investor experience design.

Today, we help sponsors launch repeatable systems to raise faster, build stronger investor relationships, and grow with confidence.

Our team has experience with all major investor portals in various capacities, and while there are many great options, one group stands out above the rest.

Based on our evaluation criteria of quick customer support, ease of fund administration, and value for investment, we recommend SponsorCloud. This group is genuinely committed to the fundraising success of the capital syndication community.

Whether you are raising for an individual asset or a fund, we recommend starting your investor portal research by scheduling a call with their team.